Eyes Wide Open - Market Colour on E-Communications Surveillance

Electronic communications surveillance is a critical compliance function for banks and financial institutions, helping them monitor employee communications for potential misconduct or regulatory breaches. However, our recent market research reveals that many banks are struggling with the current state of surveillance technology and tools. The research, which involved interviews with compliance leaders at 15 global and regional banks, uncovered several key findings:

Dissatisfaction with AI/ML models: Banks expressed growing frustration that the AI and machine learning models used in many surveillance tools have not delivered the expected benefits. While these models can reduce alert volumes to some degree, they often fail to identify all the risks they are designed to detect, leaving compliance risks undetected. The models also struggle with non-English language communications.

Legacy voice surveillance tools falling short: Many banks still rely on older, phonics-based voice surveillance tools that are now viewed as outdated. Banks are looking to move towards voice-to-text transcription tools as the next step, but are finding signific

Accuracy issues with voice transcription: The banks experimenting with voice-to-text transcription tools are reporting poor accuracy, especially for non-English languages. One bank using a market-leading transcription plus translation vendor said they were achieving around 80% accuracy for English but only 60% for Japanese. These low accuracy is leading many banks to hold off on widespread deployment.

Resource-intensive testing and deployment: Banks face significant hurdles in thoroughly testing surveillance tools before deployment, often lacking the resources and technical support needed. Testing can be time and labor-intensive, and several banks cited that after a POC process results were so far from the promised result that they were not prepared to deploy anyway.

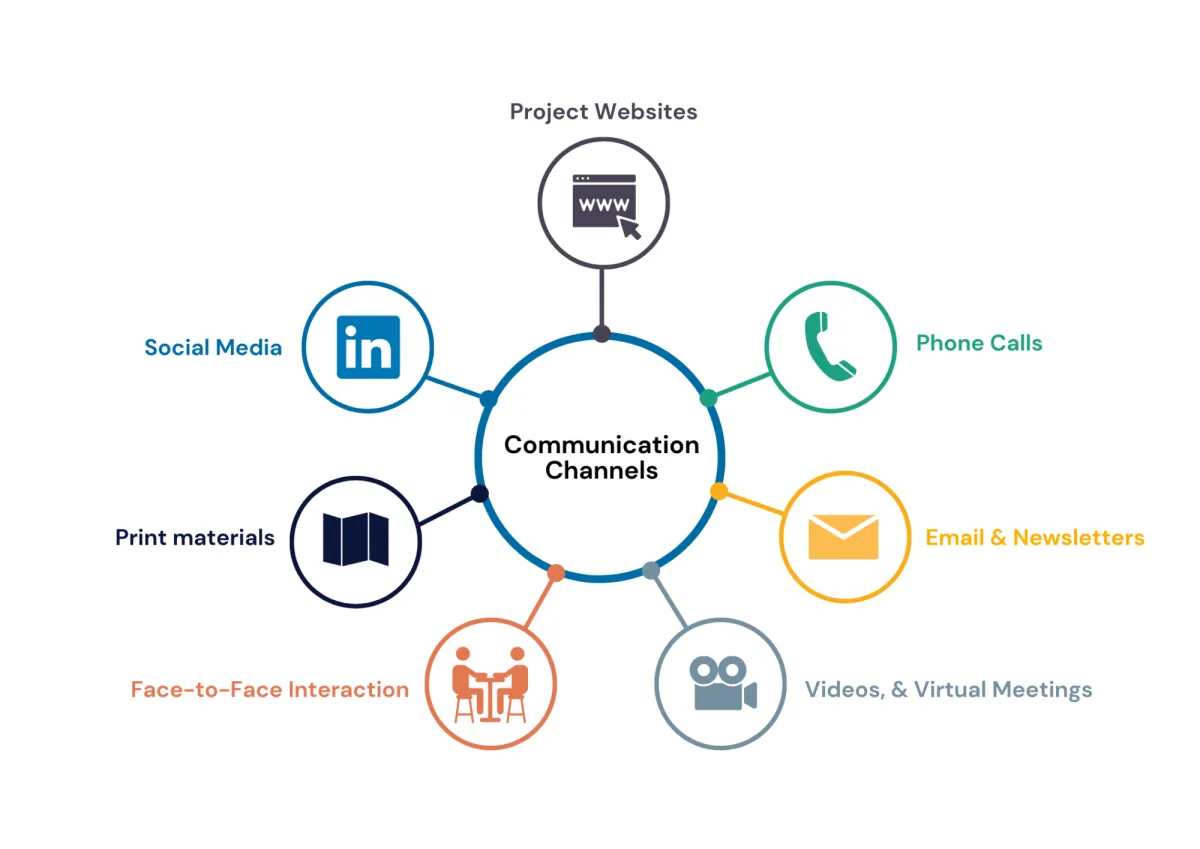

Stretched compliance teams: With static budgets, headcount pressure alongside growing regulatory expectations, compliance teams are struggling to keep up with the increasing volume and complexity of communications channels they need to monitor. This has left many teams feeling overwhelmed and under-resourced.

The findings paint a picture of an industry in transition, with banks seeking to modernise their electronic communications surveillance capabilities but facing technological, organisational, and resource challenges along the way. As regulators continue to heighten expectations, banks will need to find ways to overcome these hurdles to ensure effective surveillance and compliance - particularly when it comes to voice-to-text transcription capabilities.

If you are grappling with this, or related surveillance issues, feel free to reach out to me for an informal discussion about how I may assist.